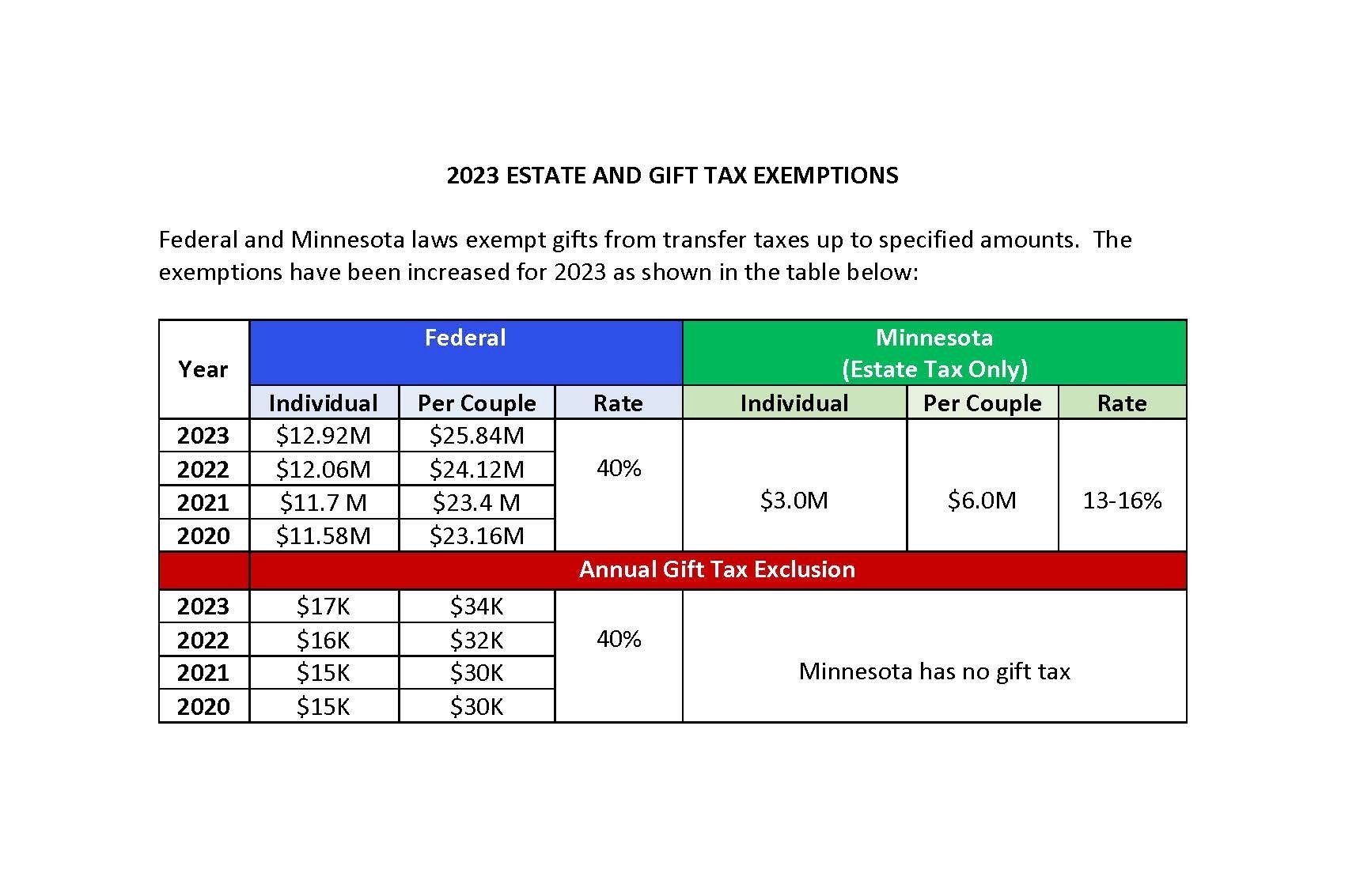

2025 Gift Tax Exemption For Seniors. You can give up to $18,000 to any individual in 2025 without triggering the gift tax. The federal estate tax exemption amount went up again for 2025.

The federal estate tax exemption amount went up again for 2025. The tax cuts and jobs act delivered a sizable increase in the tax exemption limit for estates and lifetime gifts — up to $13.61 million per person in 2025.

Lifetime Gift And Estate Tax Exemption 2025 Erica Jacinda, In 2025, that number increased to $19,000.

.jpg)

Gift Tax Limit 2025 Exemptions, Gift Tax Rates & Limits Explained, Now, if you are 65 or older and blind, the extra standard deduction for 2025 is $3,900 if you are single or filing as head of household.

What Is The Federal Gift Tax Exemption For 2025 Janey Lisbeth, For 2025, the irs has increased the annual gift tax exclusion for individuals from $17,000 to $18,000.

Lifetime Estate And Gift Tax Exemption 2025 Nancy Valerie, 19 rows here we have provided a “cheat sheet” to keep in mind.

Gift Tax Exemption 2025 Alma Lyndel, In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.